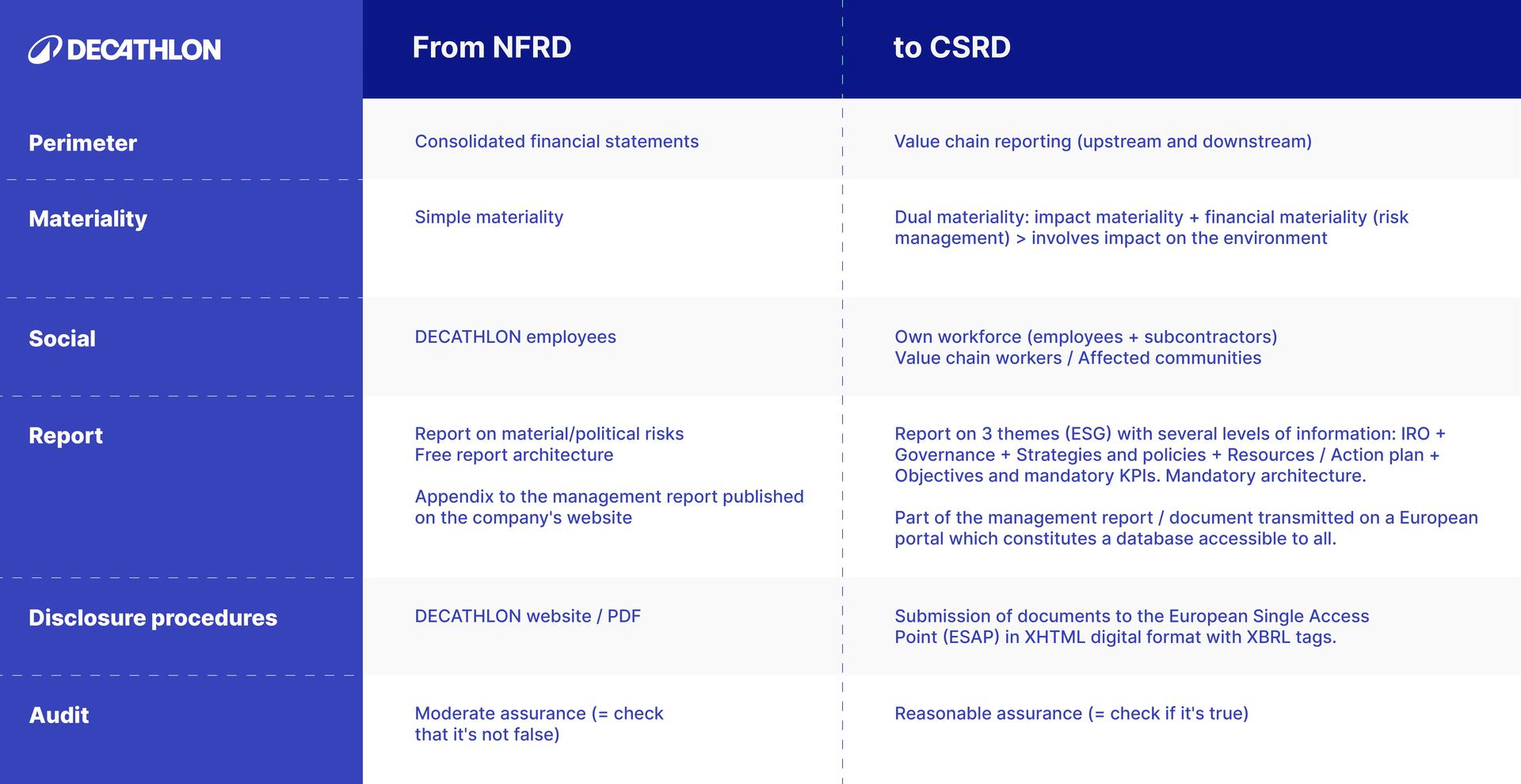

What is the difference between CSRD and NFRD?

In the CSRD European Directive line of sight is the European Green Deal that aims to deliver net zero carbon emissions in the EU by 2050.

So, CRSD's main objective is to therefore harmonise companies' sustainability reporting and improve the comparability and quality of environmental, social and governance (ESG) data published by companies.

If non-financial reporting already existed - it was structured until now by the framework set out in the 2014 NFRD directive -, with the idea, this time, being to perfect and amplify it.

Beyond this organisational objective, CSRD is obviously part of an overall project: that of a more virtuous European Union in the face of the climate crisis and its social challenges.

Here are the main noteworthy principles:

- A broader scope: CSRD applies to many more companies than NFRD. Eventually, all companies (except micro-enterprises) listed in regulated European markets will be subject to it. It also applies to large companies (which fulfil at least two of the three following criteria: an average number of 250 employees during the financial year, Net turnover of €50 million and Balance sheet assets greater than €25 million.

Meaning over 50,000 companies in 2028 compared to 11,000 today. Foreign subsidiaries will be added according to certain factors.

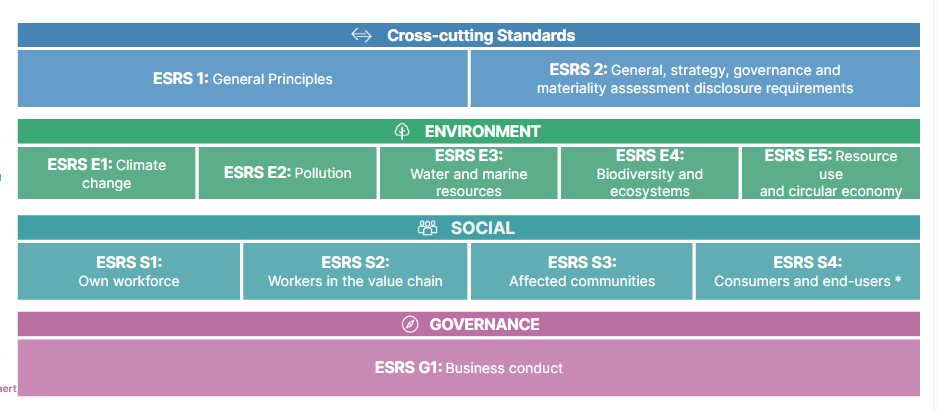

- More rigorous standardisation and reporting: to standardise non-financial reporting, CSRD introduces, in addition to the directive text, new harmonised European standards. These are the "ESRS" that stands for European Sustainability Reporting Standards.

They are based on 3 traditional ESG pillars, divided into 12 themes:

2 general themes: general requirements (ESRS 1) and general information (ESRS 2),

5 environmental themes: Climate change (ESRS E1), Pollution (ESRS E2), Water and marine resources (ESRS E3), Biodiversity and ecosystems (ESRS E4); and Resource use and Circular economy (ESRS E5),

4 social themes: Own workforce (ESRS S1), Workers in the value chain (ESRS S2), Affected Communities (ESRS S3), and Consumers and end users (ESRS S4),

1 governance topics: Business conduct (ESRS G1).

- One single place: the sustainability report should be published in a dedicated section of the management report.

- A compulsory digital format: the management report will have to be published in a unique digital reporting format -XBRL- (then uploaded to a single European access point: ESAP).

- A mandatory audit of the information by an external auditor or by an independent third-party organisation.